Our 2023 Federal Budget article highlights the matters we deem to be most relevant to the majority of our business owner clients. Click here to download our more comprehensive Federal Budget commentary.

On March 28th, 2023, the Deputy Prime Minister and Finance Minister, the Honourable Chrystia Freeland, presented the 2023 Federal Budget ("the Budget"). Titled “A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future” this budget offers support to lower income Canadians with an expansion of the Canadian dental care plan and a grocery rebate, some efforts to make business transitions easier, several green economy initiatives and more.

The Budget contained no changes to personal or corporate tax rates, nor the inclusion rate on taxable capital gains. The 2022-23 deficit is expected to be $43 billion which represents a decrease from the 2022 Budget projected deficit for the same time period of $52.8 billion and projects a declining but persistent deficit through 2027-2028.

Historically where parents transferred shares of their corporation to a corporation owned by their children, deemed dividends rather than capital gains would arise on the disposition of such shares. In 2021, legislation was passed (Bill C-208) to provide an exception from this deemed dividend treatment to facilitate the transfer of family businesses to the next generation. This exception allowed parents to utilize the lifetime capital gains exemption or simply receive capital gain treatment on the disposition, and enjoy the same tax benefits available on a sale to unrelated third parties.

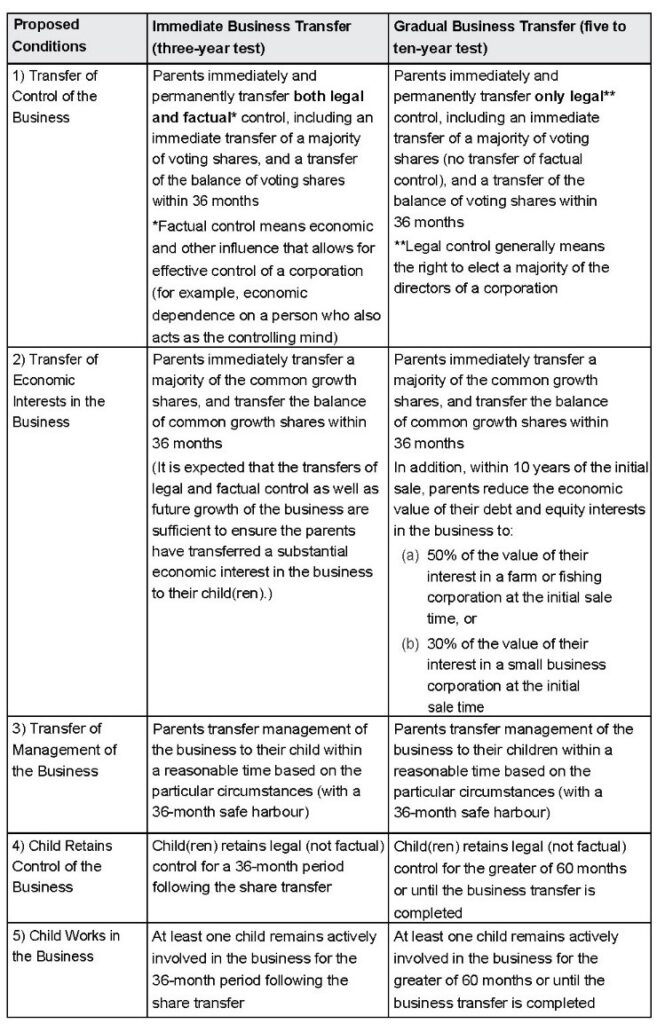

However, the Department of Finance was concerned that this exception contained insufficient safeguards and may have provided an inappropriate tax advantage where there was no factual transfer of a business to the next generation. Budget 2023 proposes to amend these rules to ensure that they apply only where a genuine intergenerational business transfer (IBT) takes place whereby the following conditions are satisfied:

Appendix A provides for a more detailed elaboration of the above conditions.

Budget 2023 also proposes to provide a ten-year capital gains reserve for a “genuine” IBT involving shares which would allow capital gains to be brought into income over a period of up to ten years, in proportion to proceeds received. The normal limit for such reserves is five years. These rules would apply to share sales occurring on or after January 1, 2024.

Budget 2023 proposed a new structure for employees to obtain an indirect equity interest in a business. An EOT is a form of employee ownership where a trust holds shares of a corporation for the benefit of the corporation’s employees. EOTs can be used to facilitate the acquisition by employees of their employer’s business, without requiring them to pay directly to acquire shares. Such a structure will provide business owners an additional option for succession planning. Budget 2023 proposes new rules to facilitate the use of EOTs to acquire and hold shares of a business. Complex requirements are set out in draft legislation included in the Budget papers.

These amendments would apply as of January 1, 2024.

The 2022 Fall Economic Statement announced the government’s intention to introduce a 2% tax on the net value of all types of share repurchases by public corporations in Canada. Budget 2023 provides the design and implementation details of the proposed measure. The tax would apply only to public corporations (Canadian-resident corporations whose shares are listed on a designated stock exchange).

It would not apply to mutual fund corporations, but would apply to real estate investment trusts, specified investment flow-through (SIFT) trusts and SIFT partnerships if they have units listed on a designated stock exchange. The proposed tax would apply in respect of repurchases and issuances of equity that occur on or after January 1, 2024.

The Income Tax Act’s GAAR is intended to prevent abusive tax avoidance transactions while not interfering with legitimate commercial and family transactions. If abusive tax avoidance is established, the GAAR applies to deny the tax benefit created by the abusive transaction.

A consultation on various approaches to modernizing and strengthening the GAAR has recently been conducted. A consultation paper released last August identified a number of issues with the GAAR and set out potential ways to address them. As part of the consultation, the government received a number of submissions, representing a wide variety of viewpoints.

Budget 2023’s GAAR proposal would not supplant the general approach under Canadian income tax law, which focuses on the legal form of an arrangement. In particular, it would not require an enquiry into what the economic substance of a transaction actually is (e.g., whether a particular financial instrument is, in substance, debt or equity). Rather, it would require consideration of a lack of economic substance in the determination of abusive tax avoidance.

A penalty would be introduced for transactions subject to the GAAR, equal to 25% of the amount of the tax benefit. Where the tax benefit involves a tax attribute that has not yet been used to reduce tax, the amount of the tax benefit would be considered to be nil. The penalty could be avoided if the transaction is disclosed to CRA, either as part of mandatory disclosure rules which are currently proposed or voluntarily. A three-year extension to the normal reassessment period would be provided for GAAR assessments, unless the transaction had been disclosed to CRA as discussed above.

Budget 2023 announced that commitments had been obtained from Visa and Mastercard to lower fees for small businesses. More than 90% of credit card-accepting businesses are expected to see their fees reduced by up to 27%.

Individuals will owe AMT if the tax amount calculated under the AMT regime is greater than the tax calculated under the ordinary progressive tax rate regime. Under the current rules, the calculation of AMT allows fewer deductions, exemptions and tax credits than under the ordinary income tax rules and applies a flat 15% tax on income over a standard $40,000 exemption.

Budget 2023 proposes several changes to the AMT calculation. First, the AMT rate is proposed to increase from 15% to 20.5%.

Second, the exemption would increase from $40,000 to the start of the fourth tax bracket (for 2024 this amount is approximately $173,000). Third, the AMT base would be broadened by further limiting tax preferences (i.e., exemptions, deductions and credits) as follows:

The ability to recover AMT in the seven subsequent years, to the extent that tax computed under the ordinary progressive tax rate regime exceeds AMT, is not proposed to change. The proposed changes would come into force for the 2024 personal tax year.

Under the current law, beneficiaries that are full-time students cannot withdraw more than $5,000 in education assistance payments (EAP) in respect of the first 13 consecutive weeks of enrollment in a 12-month period. For part-time students, the limit is $2,500 per 13-week period. Budget 2023 proposes to increase these limits to $8,000 for full-time students and $4,000 for part-time students.

Budget 2023 also proposes to enable divorced or separated parents to open joint RESPs for one or more of their children or to move an existing joint RESP to another promoter. Under the current law, only spouses or common-law partners can jointly enter into an agreement with an RESP promoter to open an RESP.

Budget 2023 proposes increasing Canada student grants by 40%, raising the interest-free Canada student loan limit from $210 to $300 per study week, and waiving the requirement for mature students (aged 22 or older) to undergo credit screening in order to qualify.

Where the contractual competence of a person with a disability who is 18 years of age or older is in doubt, the RDSP plan holder must be that person’s guardian or legal representative. A temporary measure allowed the person’s parent, spouse or common-law partner (a “qualifying family member”) to open an RDSP and be the plan holder where the person does not have a legal representative.

Budget 2023 proposes to extend this measure by three years, to December 31, 2026. Budget 2023 also proposes to broaden the definition of qualifying family members to include a brother or sister of the beneficiary who is 18 years of age or older. Qualifying family members who become a plan holder before the end of 2026 could remain the plan holder after 2026. These proposals would apply as of Royal Assent of the enacting legislation.

Under the current law, a tradesperson can claim a deduction of up to $500 of eligible new tools acquired in a taxation year as a condition of employment. Budget 2023 proposes to double the maximum employment deduction for tradespeople’s tools from $500 to $1,000, effective for 2023 and subsequent taxation years. As a consequence of this change, extraordinary tool costs that are eligible to be deducted under the apprentice vehicle mechanics’ tools deduction would be those costs that exceed the combined amount of the increased deduction for tradespeople’s tool expenses ($1,000) and the Canada employment credit ($1,368 in 2023) or 5% of the taxpayer’s income earned as an apprentice mechanic, whichever is greater.

Individuals and families with modest incomes receive the Goods and Services Tax Credit (GSTC). The maximum 2022/2023 GSTC is $467 for a single person, and $612 plus $161 per child for a married or common-law couple. Budget 2023 proposes a one-time payment called the Grocery Rebate which will equal half of the annual maximum GSTC (twice the quarterly payment received in January, 2023) to be paid as soon as possible after the legislation is passed.

The Canadian dental care plan would provide coverage for all uninsured Canadians with an annual family income of less than $90,000 (the Canada dental benefit only provided benefits for children under 12) by the end of 2023. The plan will be administered by Health Canada with support from a third-party benefits administrator. Benefits are reduced for families with income between $70,000 and $90,000.

Click here to download a full commentary on relevant Federal Budget items and reach out to a Bateman MacKay Business Advisor for guidance on how these budgetary changes may impact your business.

For further details on the Green Economy Measures, view our full commentary.

Sign up for our newsletter and receive tax, accounting, and business advisory resources for your business!